Leave a Legacy through Planned Giving

Please Note: The following information is not professional legal or tax advice. Consult your legal and tax advisors regarding your specific situation.

Communities In Schools: Shaping the Next Generation

Your planned gift with CIS will enable us to plan for the future, grow and increase the number of students we serve, and ensure that future generations will have every opportunity to succeed and live purposeful, meaningful lives. What better gift could you leave our community’s children?

Planned Giving through Communities In Schools

Whatever your stage in life, planned giving can benefit you and your loved ones, while helping to ensure future generations of underserved youth have the support and resources they need to thrive and succeed in school and in life. Some planned gifts have an impact now, some after your lifetime. Many offer tax savings, and some even provide you with income for life. Below are just a few examples of standard planned giving options.

Gifts Now That Can Provide Tax Benefits

These options may provide significant tax benefits, depending upon your situation.

- Appreciated Securities (Stocks, Bonds, Securities, Other Assets)

- Charitable IRA Rollover

- Gifts of Real Estate

Gifts that Pay Income

These financial tools can provide an additional source of income for you and your family, as well as tax benefits.

- Charitable Gift Annuity

- Charitable Remainder Trust

- Charitable Lead Trust

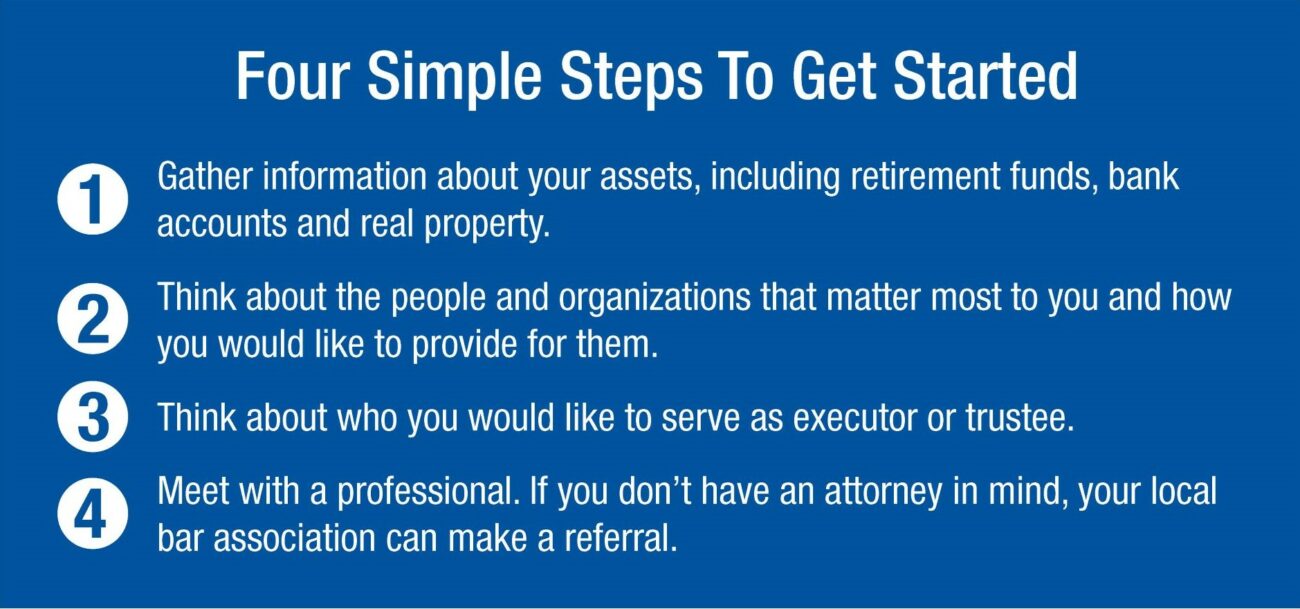

Gifts Later – Estate Planning

Creating a will or trust is a smart way to provide for your loved ones and the causes you care about. And, designating a charity in your will or trust is one of the simplest gifts to arrange. With the help of your attorney or financial advisor, you can include language in your will or trust specifying a gift be made (a specific dollar amount or a percentage) to CIS as part of your estate plan. You can also designate a charitable organization as the beneficiary in a life insurance policy.

- Wills and Charitable Bequests

- Life Insurance Policies

sample language for wills and trusts

For an unrestricted gift that allows Communities In Schools of Charlotte-Mecklenburg to determine how to use the funds based on the most pressing needs, use the following language for your will and/or trust:

I give to Communities In Schools of Charlotte-Mecklenburg, a 501(c)(3) nonprofit organization located in Charlotte, NC, $_____________ (insert a specific dollar amount or a percentage) of the rest, residue, and remainder of my estate as an unrestricted gift to be used for its general mission.

Federal Tax ID Number: 58-1661795

Bequest Intent form

If you have named Communities In Schools of Charlotte-Mecklenburg in your will or trust, please let us know by completing this Bequest Intent Form so we can ensure that your gift is used according to your wishes. Notifying us of your plans will enable us to plan for the use of your future gift. If you prefer to remain anonymous, please indicate on the form and we will keep your name and gift in strict confidence.

Ready to Explore Planned Giving?

Contact a member of our Advancement Team at advancement@cischarlotte.org.